Lido holds 76% of ETH staking: Does LDO stand to gain?

December 21, 2023

By Aniket Verma

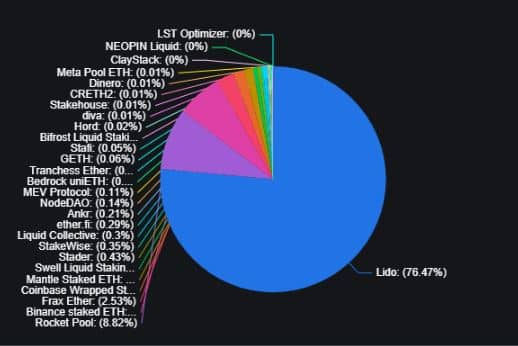

Lido held a 76.47% share of the ETH staking market.

The value of Lido’s deposits has more than tripled since the start of 2023.

An investor staked $69 million in the staking pool operated by Lido Finance [LDO], the largest liquid staking protocol. The claim was made in an X post by Alex Svanevik, CEO of popular on-chain analyst firm Nansen.

In a statement shared with AMBCrypto, Nansen stated that the deposits, made in Ethereum [ETH], boosted Lido’s staked ETH numbers, further solidifying its market domination.

Lido remains the boss

As per AMBCrypto’s examination of DeFiLlama’s data, ETH worth nearly $20.2 billion was locked with Lido as of this writing. The staking giant held an astounding 76.47% share of ETH’s staking market.

Source: DeFiLlama

The Total Value Locked (TVL) on the platform, including deposits of other tokens like MATIC, was about $20.37 billion, making it the largest decentralized finance (DeFi) project by a mile.

To get a sense of proportion, Lido’s TVL as of press time was more than the combined TVL of the second and third-ranked protocols on the list.

The value of Lido’s deposits has more than tripled since the start of 2023. Crucial developments over the year played a significant role in boosting Lido’s demand in the market.

The most prominent was the launch of its version 2, allowing users to withdraw their Staked ETH [stETH] to Ethereum. This of course after the tech was enabled from Ethereum’s side following the Shapella Upgrade in May.

In addition, the sharp increase in ETH’s market value in the last quarter gave impetus to the USD value of the deposited funds.

To read entire article…Click Here!